Flat Tax or Fair Tax?

Back when we used to do our Libertarian Party outreach table at the Old Town Fourth of July Festival, there was a lady who ran an appliance store somewhere in Old Town that came by our table probably three years in a row. She'd stop, jam her finger down on the table and ask, "Ok, which is it: Fair Tax or Flat Tax?" She never seemed to remember she asked the same question to the same person in exactly the same way the year before.

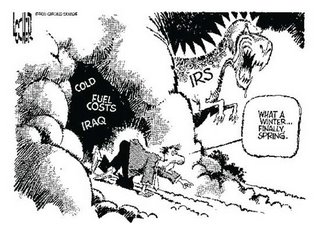

I was hard pressed to answer the question with a straight answer of either one tax or the other. Reason being, as I told her, both forms of tax do nothing to address government spending. They're simply different ways of collecting the same billions or trillions of dollars from people only to be redistributed by government.

I suppose that's a moot point, though, since the question is which method of taxation would be preferable to what we have now. As to that, I'm not sure.

Both our very own Leonidas and local gadfly, Jerry Partain, favor the Fair Tax, which would basically take the form of a National Sales Tax. I don't know that I agree, especially when most estimates I've seen of the percent of tax on sales to replace current income tax revenue would be around 30%. So, if you don't like the current 8%, or whatever it is around here, you'll really be hating it when you end up paying close to a third more in taxes for that car or computer you just bought.

Some of the benefits touted by Fair Tax proponents I see as disadvantages. For one; that nobody can escape the tax as it's made upon sale of new goods. I don't like that, but that's mostly because I happen to be an admirer of the underground economy.

Certainly it would be nice to do away with the filing of income taxes each year but, as Leonidas points out in his comments about the Fair Tax, we'd still be filing state income taxes. What's to say the state won't increase their income tax rate with the rationalization that Californians no longer pay the federal income tax so they should pay more state income tax? I understand they did just that with some of the Bush Tax cuts, or were working on it.

That lady that used to come by our LP table in Old Town pointed out that the National Sales Tax would be harmful to her business as only new items were taxed. Since she sold appliances, she did indeed face the prospect of a serious loss in sales. She made a good point. I don't know that I'd go for this Fair Tax.

The other plan, The Flat Tax, would be a flat income tax where everyone pays the same rate of, say, 5% on all income earned with no deductions of any kind. I believe I've read some proposals for an even higher percentage, maybe even up to 15%. This is the tax system Rep. Dick Armey was campaigning for. The one where you could file your taxes by just filing out a post card.

For me, being self- employed, the thought of no deductions is troubling and I just don't trust the pols to keep the tax percentage at the level they sell the plan on. This does allow the underground economy a chance to avoid the tax man and I find that to be a good thing although, admittedly, most people don't.

I guess I'd lean toward a flat income tax, if I had to chose one over the other. There's no denying it would be good to get rid of the annual ritual of getting all your papers together and hauling them off to the accountant to see how much money you can manage to keep in the bank after paying your taxes.

I did that just yesterday, which is partly why this subject came up. Went to the accountant to do the preliminary work on our income taxes. A quick look at the numbers had my accountant telling me I was looking at a tax due of around $1700. The first time in a few years where I got hit hard at the time I needed to be hit hard the least.

I might be able to shave a couple hundred dollars off that after looking a little closer at expenses but, still, that really adds insult to injury as paying that bill would just about clean out my bank account, literally. I'll likely have to come up with a payment plan of some sort.

Something needs to be done about the tax code for sure. But, more importantly something needs to be done to cut government spending and I don't think most of us will live to see the day when that happens, if it happens at all.

7 Comments:

Fred,

Any thoughts on the NCJ article on various examples of railyard redevelopment? Seems pretty clear that our local government has dropped the ball when it comes to redevelopment... Is this community forced to look to public investors to get anything done?

Fair Tax is the WAY to go. Should be little change in the cost - since the sales tax only applies to the final consumer sale. So the 20% to 30% built in taxes for materials etc. would lower the price - and the sales tax would then raise it. Ne effect - zero (plus or minus a few points).

Definately a way to tax all the southern humboldt money.

No thoughts right now, 8:56. Maybe later.

Anon 8:58, wrote; "Definately a way to tax all the southern humboldt money".

Hey, I like the underground economy. I may not benefit much, if at all from it, but I'm glad for those who do.

Fred,

The BIG problem with both of the tax proposals is that the politicians can change the percentages. The Fair tax as proposed would be a nightmare if it were amended to keep the 16th Amendment in the Constitution. We could then be faced with the Swedish system which has both a steeply graduated income tax AND a 24% "value added" tax on all sales. One up side of the Fair tax proposal (which by the way taxes ALL transactions including services) is that the taxes are totally transparent instead of hidden as now. This would give pause to the politicians proclivity to raise taxes by appeals to class envy. A good discussion forum on the Fair Tax is at: http://fairtaxgroups.com/. There are links to both the text as well as a brief summary. Leonidas' sense is that both proposals are doomed as the politicians' opportunities for social engineering are curtailed.

ΜΟΛΩΝ ΛΑΒΕ

One other thing to consider, when discussing tax options is, to paraphrase Congressman Ron Paul, "We might well end up with both an income tax AND a national sales tax...".

That certainly food for thought and nowhere's near impossible.

I like the Fair Tax. Think we'll see it in our lifetime?

Depends how old you are- not in my lifetime, I don't think.

Post a Comment

<< Home